A lobby group has pressured KPMG into ending its

affiliation with Iranian firm Bayat Rayan.

Arvind Hickman interviews industry leaders to discuss the

circumstances surrounding KPMG’s departure and the repercussions it

will have for the developing profession in the

country.

The Impact of Politics on Iran’s Accounting Profession

KPMG has fled Iran amid fierce US lobby

group pressure. It is the last Big Four firm to leave the embattled

country, raising questions about the future of the Iran’s

accounting profession as well as the moral integrity of using

economic sanctions to remove an unpopular regime.

Experts, including the leader of the

International Federation of Accountants (IFAC) warn the Big Four’s

departure could stall the development of Iran’s profession. A

broader exodus of foreign companies will seriously destabilise the

country’s economy, which is already suffering chronic inflation due

to a shortage of imported goods.

Bayat Rayan, a part of the KPMG family a month

ago, believes foreign companies will still use its services as

there is little choice in the market, and the Big Four will return

to the resource rich nation once the political situation is

resolved.

Lobby group pressure

KPMG’s departure was engineered by the United

Against Nuclear Iran (UANI), a coalition of lobby groups that wants

to prevent Iran from becoming a regional power with nuclear

weapons, although scratch the surface and it is clear the lobby

group has other interests, including regime change.

The lobby group dismissed concerns about Iran’s

accounting profession while lauding KPMG’s decision as “helpful to

our cause on a greater level than any company operating in

Iran”.

For its part, KPMG has remained largely silent

on this issue, confirming it ended its working relationship with

Bayat Rayan due to concerns raised by the UANI. KPMG’s silence is

common among accounting firms who often shy away from politically

sensitive issues.

Iran’s top 10

Bayat Rayan is a top-six domestic firm

with 55 staff that provides audit, accountancy, tax and advisory

services, primarily to Iran’s private sector.

The Iranian profession is dominated by 10 audit

firms: Audit Organization, Dayarayan, Agahan Moshar, Bayat Rayan,

Behrad Moshar, Behmand, Fater, Iran Mashhood, Rymand & Co and

Tadvin, according to Dayarayan managing partner Gholamhossein

Davani.

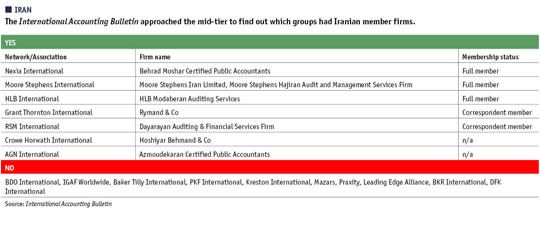

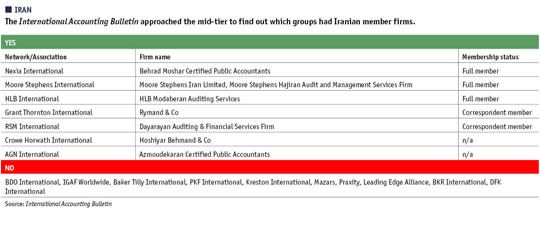

The Accountant’s sister

publication, International Accounting Bulletin, researched

the Iranian accounting profession and found there are at least

seven global mid-tier networks that still have Iranian affiliates

(see chart below). These groups play and will continue to

play an important role in assisting their Iranian affiliates to

develop international standards and best practices.

Davani explains the

state-owned Audit Organization is the largest firm and audits 80%

of the audit market, including Iran’s government companies and

public institutes. The rest of the pack focuses on the private

sector. Davani estimates the total revenue generated by the audit

market is about $90m of which Audit Organization earns $60m.

It is unclear what cut Bayat Rayan takes out of

the Iranian audit market but it is significantly less than what

KPMG earns from US federal contracts each year – the Big Four firm

is reported to have earned $1.2bn in the past decade.

For this reason alone, Bayat Rayan partner Ali

Jan believes KPMG had “little choice” but to end its working

relationship.

“Common sense tells me that if my interests is

somewhere else and they are going to make me subject to sanctions,

then I really need to make a decision on where I am going to lose

most if I am not following the rules,” Jan says.

No alternative

Jan does not believe the break-up will

have a major impact upon Bayat Rayan’s bottom line because a large

bulk of its business is local and there’s little alternative for

foreign companies in Iran.

“We’ve got international clients which operate

here and under law have to have their accounts audited in

accordance with the local laws,” he explains.

“Either they use us or they use another firm

like us, so really at the end of it [they shouldn’t go elsewhere]

because there is no alternative. All the major international firms

have gone so there is no choice.

“One way or another we may get affected

slightly but we still have expatriate clients ringing us still

making enquiries. I do not expect a major upheaval. It all has to

be sorted out at a much higher level than KPMG, what is happening

in the world, in the UN.

“At the diplomatic level this has to be

resolved and once that’s resolved the business will follow.”

Threat to the economy

Davani is concerned that foreign firms and

companies leaving Iran will not only directly affect the local

audit market but also collapse the economy.

“It is self evident that if they comply with

the sanctions, foreign companies shall be out of Iran and the

revenue of audit firms who are engaged with foreign clients will be

reduce so much,” Davani says.

“Even revenue of other audit firms [will

be affected] because the economy will collapse.”

Both Jan and Davani point out the Iranian

profession went through a similar exodus following the Islamic

Revolution in 1979 and recovered.

“We have been through this before, it is not

the first time and I’m sure multinationals will come here,” Jan

says.

“Once you start working in this part of the

world, disappointment doesn’t mean much. You have to survive and

you do survive.”

Development headache

Even if firms do survive the desertion

of foreign companies, the departure of the Big Four could delay

professional development in Iran, according to one of the world’s

leading accountants.

Iranian professional accountants are trained by

professional accounting bodies and at firms like Bayat Rayan. Being

affiliated with a Big Four network allows domestic firms to tap

into vast technical resources, training programmes and global best

practices. This is particularly important for keeping up to speed

with international changes to accounting and auditing

standards.

IFAC president Robert Bunting says the Big Four

leaving any country could be “potentially devastating”,

highlighting the important role these networks play in providing

on-the-job training. Big Four networks also provide support and

resources to professional accounting bodies, such as the Iranian

Association of Certified Public Accountants.

“You are cut off from resources and you’re cut

off from colleague contacts,” Bunting says.

“There is no more inbound investment [by the

Big Four firms]. In a lot of countries the large firms and large

networks are net investors because they don’t profit at all from

being in the country, they are simply financially supporting their

office there.

“So you look at that and it is potentially

devastating to the profession. Certainly it is going to delay the

development of the profession for a long time.”

accepts that belonging to a network has its own

benefits, “because you get the technical know how, you have access

to research, access to training and things like that which are

within that international domain”.

“But having said that, we are now back on the

same footing as all other firms operating in Iran,” he adds.

Both Jan and Davani contend that resources are

still largely available on the internet and through staff

membership of professional bodies abroad.

At Bayat Rayan, several professionals have

access to resources from the Institute of Chartered Accountants in

England and Wales, among other bodies. He hopes these connections

will help mitigate the loss of materials and support from KPMG.

Another effect KPMG’s departure could have on

Bayat Rayan is the removal of KPMG’s strict quality control

infrastructure, which polices auditor practice across the

network.

Firms that belong to networks such as KPMG are

regularly inspected to ensure they comply with high global

standards. The loss of this oversight could eventually filter down

to audit quality if careful monitoring is not picked up

elsewhere.

Sending a message

The UANI argues that KPMG’s departure

from the country will not devastate the domestic accounting

profession.

“I can’t imagine KPMG is the only accounting

firm left in Iran,” UANI spokesperson Kimberlyn Lipscomb says.

“It certainly sends a message to the Iranian

regime that the Big Four international accounting firms are not

willing to provide services to a brutal regime.”

Lipscomb also does not believe economic

sanctions will affect the people of Iran more so than its

government – a common criticism of economic intervention

mechanisms.

“I don’t think it is hard to argue that what

the Iranian regime is doing to its own people is significantly more

brutal than KPMG’s decision not to operate in Iran,” she says.

Lipscomb cites South Africa as an example of

where the “divestment movement during apartheid proved to be

effective”.

An example closer to Iran is the brutal UN

Security Council-imposed economic sanctions forced on Iraq between

1990 and 2003.

The United Nations Children’s Fund estimates

these sanctions were responsible for the deaths of at least half a

million children while doing little to affect the powerbase of

Saddam Hussein.

Davani questions the UANI’s motives and

believes all professions – such as accounting, lawyers and medicine

“must be [left] out of political matters”.

Profession battles on

Iran’s profession has undergone

setbacks before when global organisations have left for political

reasons and industry leaders are confident they will return when

the time is right.

Further, it’s important to note that several

mid-tier networks are active in Iran, playing an important role in

helping the local profession develop global standards. Iranian

professionals are also well educated, resourceful and often qualify

with globally recognised professional bodies.

Other organisations, such as IFAC, provide

assistance, whether this is on a formal or informal basis.

However, there is certainly the risk that a

potentially toxic political situation could spiral further out of

control and economic sanctions become much harder hitting. In

addition, the UANI’s campaign against foreign organisations could

yet threaten the Iranian operations of other international

accounting groups.

Iranian accounting firms won’t hold their

breath in the hope stability will return any time soon. But also

don’t expect this profession to stagnate or go backwards, it has

battled hardship before and will survive this latest setback.

“Iran exodus: Politics strikes profession” was originally created and published by The Accountant, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.